Understanding How You Can Recover Lost Vehicle Value After an Accident

After a car accident, even if your vehicle has been repaired to like-new condition, it may never regain its full market value. Buyers are less likely to pay top dollar for a car that has an accident history, even with quality repairs. This is where a diminished value claim comes in.

At My Auto Claim, we specialize in helping drivers recover money they may not even realize they’ve lost. If your car has dropped in value after an accident, we’ll help you fight for the compensation you deserve—quickly, clearly, and with zero stress. Call today and see what your damaged vehicle is worth!

What Exactly Is Diminished Value?

Diminished value refers to the loss in market value your vehicle suffers after an accident, even after it’s been fully repaired. Once a car has a record of damage, its resale or trade-in value usually takes a hit. Prospective buyers or dealerships often consider it “less desirable” simply because it’s been involved in a collision.

There are typically three types of diminished value:

- Immediate Diminished Value: The difference in resale value immediately after the accident, before any repairs are made.

- Inherent Diminished Value: The most common type—the loss in value that remains even after the car is professionally repaired.

- Repair-Related Diminished Value: Loss of value due to low-quality repairs or the use of non-OEM (original equipment manufacturer) parts.

Why Don’t More People Know About This?

Insurance companies rarely mention diminished value claims. Unless you bring it up and push for it, it may never be offered. This is why My Auto Claim exists—to bridge that knowledge gap and give consumers the tools and support they need to demand fair compensation.

Most drivers focus on getting their cars fixed quickly after a crash, but forget to consider what happens to the car’s long-term value. That’s where money is left on the table.

Do You Qualify for a Diminished Value Claim?

You might qualify if:

- The accident was not your fault (third-party claims)

- Your car has been fully repaired

- The car is under 10 years old

- The vehicle has a clean title (not salvaged or rebuilt)

- The accident is listed on your Carfax report

Even if you’re not sure, My Auto Claim can assess your eligibility with a free, no-obligation evaluation.

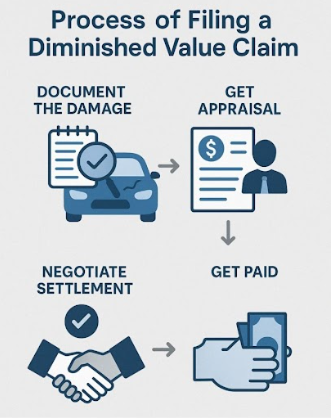

How Does the Process Work?

- Get a Free Evaluation: Submit your vehicle details and accident info to us.

- Get Your Report: Our licensed appraisers create a professional diminished value report.

- File Your Claim: We help you submit everything to the responsible insurer.

- Negotiate (If Needed): We back you with expert support, every step of the way.

You don’t need to be a lawyer or insurance expert—we guide you through the entire process.

How Much Money Can You Get Back?

The payout depends on several factors:

- Your vehicle’s pre-accident value

- The severity of the damage

- Your car’s age, mileage, and make/model

- Your state’s laws on diminished value

- Who was at fault

On average, claims can range from a few hundred to several thousand dollars. For example, if your vehicle was worth $25,000 before the crash, you could be owed $3,000–$7,000 depending on the circumstances.

What Are the Common Obstacles?

Insurance companies may try to:

- Claim the damage was minor and doesn’t impact value

- Offer a low settlement

- Ignore your request for a diminished value appraisal

They may also only consider the cost of repairs, not how the accident affects the car’s perceived worth. That’s why having a detailed, expert-backed report is crucial.

What Makes My Auto Claim Different?

We’re not a law firm. We’re not a giant insurance company. We’re a consumer-focused team of licensed appraisers and claim experts who know this industry inside and out. Our goal is simple: to help you get paid what your car is really worth.

We offer:

- Free claim evaluations

- Flat-rate, transparent pricing

- Professional reports accepted by insurers

- Support with the claims process and negotiations

- No payment unless you get paid

You don’t have to figure it out alone. With My Auto Claim, you have a trusted partner who will advocate for your rights.

Ready to Take the Next Step?

If your car has lost value after an accident, don’t settle for less. Reach out today and let us show you how much you could recover with a professional diminished value claim.