Diminshed Value

Diminished Value Explained: Everything You Need to Know

Picture this: you’re driving home from work, and someone rear-ends you at a stoplight. Even after repairs, your car isn’t worth what it was before. Many car owners just like you face this reality every day. It’s called diminished value.

Diminished value is the reduction in your car’s market value after it has been in an accident and repaired. Even when a car looks as good as new, potential buyers often see a history of accidents as a red flag, which decreases its value. Understanding how diminished value works can help you recover financial losses after an accident.

We’ll explain everything you need to know about diminished value, from its definition and types to the processes involved in filing claims across different states. My Auto Claim experts will guide you through understanding your claim and dealing with insurance companies effectively. Let us help you make informed decisions to get the maximum relief possible.

What is Diminished Value?

When you get into a car accident, the damage to your vehicle affects its value. Even after you repair it, your car might still be worth less than it was before. This drop in value is what we call diminished value. It’s crucial to know about this because it can impact your financial recovery after an accident. Understanding diminished value can help ensure you get the right compensation from your insurance company. At My Auto Claim, we want to help you make sense of this, so you can confidently navigate the claims process.

Definition and Overview

Diminished value refers to the decrease in a car’s market value after an accident, even when the car has been repaired. When a vehicle is in top condition, it holds a higher value. But when there’s an accident history, potential buyers or dealers might offer less money for it. Insurance companies often recognize this lowered value, and you can file a claim to recover this loss. It’s important to understand diminished value to ensure fair compensation, especially if you’re not at fault, as the fault party may be liable for this loss.

Importance in Vehicle Valuation

Knowing how diminished value affects your vehicle’s worth is essential. Cars with any kind of accident history, even minor damage, often sell for less. Diminished value claims aim to bridge this gap. Whether you’re dealing with moderate damage or major damage, the repair-related diminished value can significantly affect your pocket. Insurance policies may cover these losses, but only if you file a diminished value claim. This is part of a property damage claim and can make a significant difference in the financial recovery after an auto accident. Always consult a professional appraiser to find out the exact loss in value.

Types of Diminished Value

When a car gets into an accident, it can lose value even after being repaired. This loss in value is called “diminished value.” It’s important to know about this because if your car gets damaged, you might be entitled to a diminished value claim. These claims help you get fair compensation for your car’s value loss. There are different types of diminished value that can affect your claim. Understanding these types can help you determine if you qualify for a diminished value claim and get the best outcome. Let’s explore these different types.

Inherent Diminished Value

Inherent diminished value refers to the loss in value that remains even after a car is properly repaired. It’s the most common type of diminished value because it results from the vehicle’s accident history alone. People often prefer cars with clean histories, and just knowing about a past accident can make a vehicle less appealing, even if it’s fixed. So, this loss happens because buyers think a car involved in an accident isn’t as valuable as a similar one that wasn’t.

An inherent diminished value claim is often easier to pursue because it doesn’t require you to prove that repairs were done poorly. The main focus is on the stigma attached to a car’s accident history. Whether it’s due to moderate damage or even minor damage, the negative perception can impact resale or trade-in values significantly. It’s essential to get a fair assessment from professional appraisers who understand the market and can argue your case effectively. By filing this type of claim, you aim to recover the loss linked directly to the vehicle’s accident mark on its record.

Immediate Diminished Value

Immediate diminished value refers to the drop in a vehicle’s value right after an accident but before it’s repaired. When an accident occurs, the car’s worth decreases immediately because it’s damaged. This type of diminished value matters if you’re planning to sell or trade the car right away, and it affects what someone would be willing to pay for it in its current, unrepaired state.

Understanding immediate diminished value is crucial for those involved in an auto accident who need quick financial relief. If your insurance company or the fault driver’s insurance downplays this loss, it can impact your compensation. For people dealing with property damage claims, recognizing this immediate loss and factoring in the accident history can mean the difference between a fair settlement and getting shortchanged. Working with an accident lawyer or seeking legal advice can sometimes help navigate this challenging claims process, ensuring that immediate diminished value is appropriately compensated.

Repair-Related Diminished Value

Repair-related diminished value happens when a vehicle loses more value because the repairs were not up to standard, or because the repairs themselves make the car less appealing. This often occurs when the repair work is noticeable and affects the car’s looks or functions. Parts might not match perfectly, or the paint could be off, leading buyers to see the car as less valuable.

To make a repair-related diminished value claim, it’s important to document the repair quality and compare it to the condition of the car before the accident. Sometimes, structural damages or major repairs leave visible marks that can make a future sale challenging. In this case, professional appraisers help assess the extent of diminished value due to repair issues. Their evaluations give you the ammunition needed to argue for fair compensation. This type of claim ensures that the cost of repair doesn’t leave you with a vehicle that’s worth less than what it should be in pristine, post-repair condition.

How is Diminished Value Calculated?

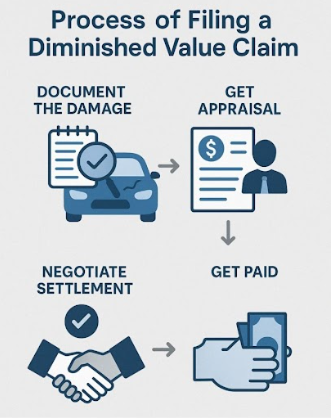

Diminished value is the loss in a car’s value after it has been in an accident. Even after repairs, a car’s worth is often less because of its accident history. To figure out this loss, insurers and experts follow certain methods. Knowing how diminished value is calculated can help you seek fair compensation. Often, a professional appraiser or an accident lawyer can help navigate this process. This calculation matters when filing a diminished value claim with your insurance company or the fault party’s insurer. Let us dive into the methods used for these calculations.

Damage Multiplier Method

The damage multiplier method is a common type when calculating diminished value. It looks at the extent of damage a car has suffered. Insurers use a damage multiplier, which is a tool, to assess the severity of repair-related diminished value. This method considers if the car had minor, moderate, or major damage. Structural damages or those affecting function usually decrease the car’s worth more. Being aware of this method can help you in the claims process, ensuring you receive the compensation you deserve for your car’s diminished value.

Mileage Multiplier Considerations

Mileage also plays a part in determining a car’s diminished value. High mileage multiplies the loss in value more than low mileage does. This factor, the mileage multiplier, acknowledges that cars with more miles are less valuable from the start. It helps adjust the diminished value claim to be fair by considering wear and tear. If your car’s mileage is low, the diminished value might be less than a similar car with high mileage. Knowing this can shape how you approach your property damage claim, making sure you get fair compensation for your car.

Role of Vehicle Age and Condition

The age and condition of a vehicle are important in the calculation of diminished value claims. Older cars may not experience as high a loss in value as newer ones after an accident. This is because their value depreciates over time, including general wear and damage from use. A car in poor condition before an accident may see lesser impact on its value versus one in excellent condition. Hence, insurers, when determining the reduced value, consider both how old the car is and its prior state. This ensures that the compensation reflects the true loss in value due to the accident, giving you a clearer idea of what you should expect in your claim.

Dealing with Insurance Companies

Insurance companies are supposed to help after an accident. But dealing with them can be hard. When your car gets damaged, its value can go down, even after repairs. This is where a diminished value claim comes in. It’s a way to ask for money to make up for the loss in your car’s value. Many people don’t know this claim exists. At My Auto Claim, we help you understand and navigate the process. Our goal is to ensure you get fair compensation for your car’s diminished value. Knowing how to approach your insurance company can make a big difference.

Addressing Resistance

Insurance companies might not want to pay for a diminished value claim right away. They often resist because it’s an extra cost. They may argue the repair was enough or point to your policy limits. But resistance doesn’t mean you should give up. Know your rights and the basics of your claim. Present evidence of your car’s loss in market value after repairs. Be prepared to show how a fault driver or accident history affects your claim. If they still resist, it might be time to get professional appraisers or legal advice. Remember, persistence is key.

Effective Strategies for Communication

Clear communication is vital when dealing with insurance companies. Start by gathering all necessary documents like repair bills and accident reports. When you talk to your insurer, be calm and clear about what you want. Make sure to document every conversation. Emailing or writing a letter can be helpful too. Focus on facts, like the cost of repair and any structural damages. If you’re unclear about terms like mileage multipliers or damage multipliers, don’t hesitate to ask. If needed, consult an accident lawyer. These strategies can make the claims process smoother and increase your chances of success.

Need help? Contact My Auto Claim today!

DIY Package

$79.99

- Instant Diminished Value Assessment

- Full Breakdown Report

- Phone and Email Support

Hybrid Package

$399.99

- Includes Perks from Basic Package

- Includes Claim Instructions

- Sample Claim Demand Letter

- Negotiation Techniques

Custom Package

Manage My Claim

- Full Service Claim Management Services

- Performed by our Trained Claim Specialists

- We Don’t Get Paid Unless You Do