Claim

Diminished Value Claim Process Explained: A Step-by-Step Guide

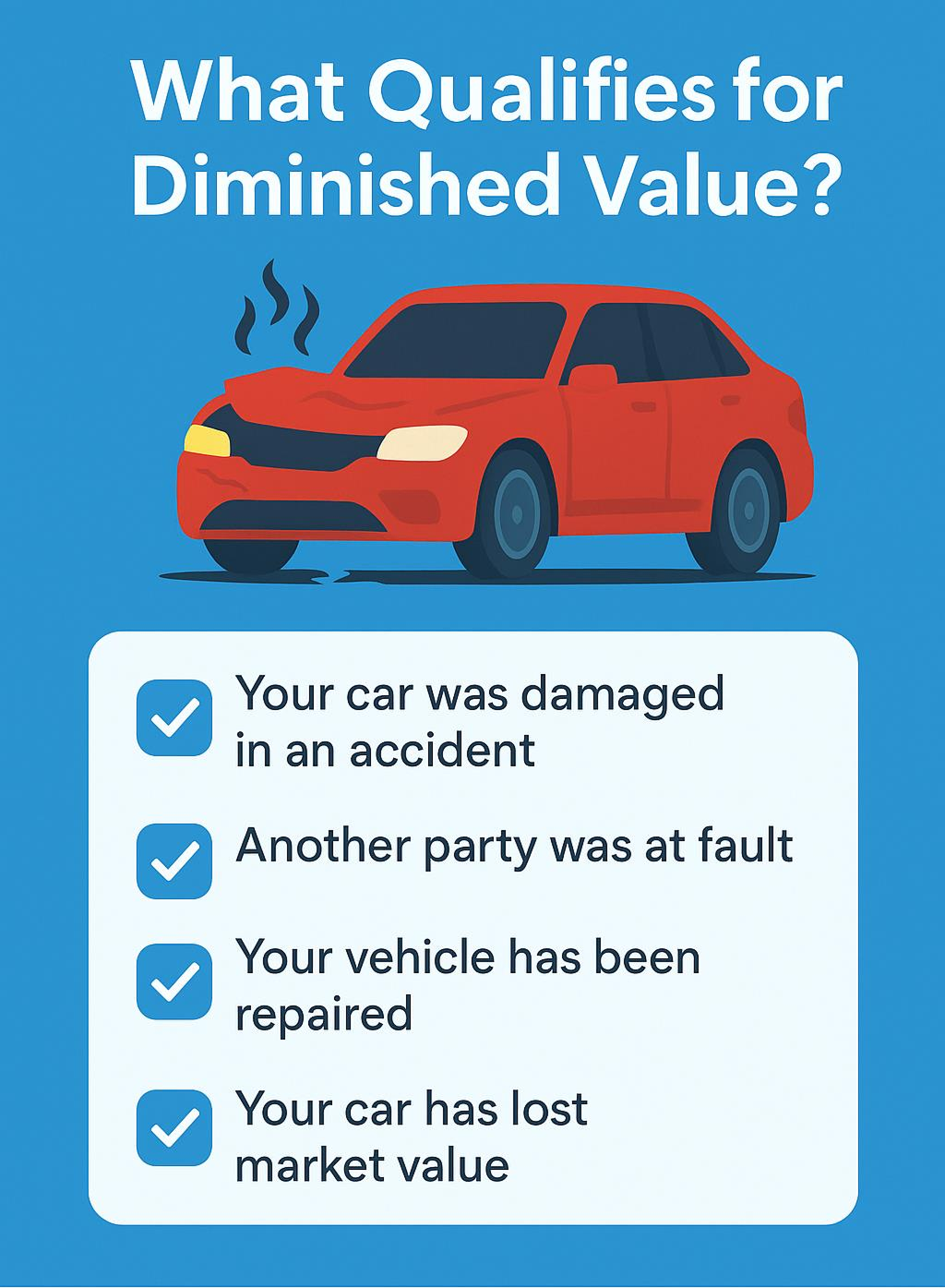

Did you know that even after repairing your car, it may never be worth as much as before the accident? This is what we call “diminished value.” It’s the loss in a vehicle’s market value due to its accident history, even after repairs.

Understanding diminished value can seem tricky, but it’s crucial for getting the right compensation. There are different types of diminished value and they’re based on how much your vehicle’s worth drops due to the accident and repair process. Knowing how to calculate this value and file a claim is key to getting the best financial outcome.

Understanding Diminished Value

When your car gets into an accident, it often loses value. This is called diminished value. Even after repairs, your car may not be worth what it was before the accident. This can hit your wallet hard if you decide to sell or trade it in.

Types of Diminished Value:

- Immediate Diminished Value: Loss right after an accident.

- Inherent Diminished Value: Permanent loss in value even after full repair.

- Repair-Related Diminished Value: Value loss due to poor repair work.

How to Claim Diminished Value:

- Check Your Insurance Policies: Some may cover this.

- Know the Fault Party: If you’re not at fault, their insurance may pay.

- Hire Professional Appraisers: They assess the true value loss.

Other Factors Influencing Claim:

- Cost of Repair: A high cost often means higher diminished value.

- Accident History: Affects future resale value.

- Type of Damage: Structural damages cause more value loss.

Don’t Wait! Reach out to My Auto Claim for expert help in getting fair compensation for your diminished value claim. Let us guide you through the claims process smoothly!

Types of Diminished Value

When it comes to understanding diminished value claims, knowing the different types is key. Diminished value is the loss in your car’s worth after an accident, even once repairs are done. It’s like a scar that can affect your car’s value at trade-in or resale. Insurance companies look at this when calculating compensation. There are three main types: inherent diminished value, repair-related diminished value, and immediate diminished value. Each type focuses on different reasons why a vehicle might lose value. Understanding these can help you make a successful claim and get the fair compensation you deserve.

Inherent Diminished Value

Inherent diminished value refers to the loss in value that remains in a vehicle after it has been fully repaired to its pre-accident condition. This loss occurs simply because the car now has a record of an accident in its history. Buyers often see this as a risk or a sign that the car may not perform as well as it should.

Even if your repair work is perfect, inherent diminished value remains. This is because potential buyers use accident history as a measure of reliability. Cars with an accident record might sell for less, as people think they may bring future problems. Insurance policies usually consider this type of claim, especially when the fault driver is clearly responsible for the crash.

When claiming, it’s critical to prove that the repairs were done well, yet the car still lost value just because of its history. With professional appraisers, you can determine how much your car’s market value decreased due to its accident history.

Repair-Related Diminished Value

Repair-related diminished value results from subpar repair work. This means that even after fixing, parts do not fully match the rest of the car or don’t function perfectly. Sometimes, the wrong materials or techniques are used, and this can be very visible or affect the car’s performance.

When seeking compensation for repair-related diminished value, evidence is your friend. Keep detailed records of the repair process, including receipts, reports, and photos. These documents can show discrepancies between pre and post-repair conditions. Insurance companies will need this information as they review your property damage claim.

Hiring a professional appraiser is beneficial here. They can precisely assess how poor repair quality has hurt your car’s value. This evaluation supports your case, especially when negotiating with the insurance company, to ensure a fair settlement is reached.

Immediate Diminished Value

Immediate diminished value occurs instantly after an accident but before any repairs have been completed. At this stage, the car’s worth drops because it is damaged and unusable. The damage multiplier at work here instantly affects resale and trade-in offers.

In many cases, insurance coverage can address immediate diminished value, especially when the fault driver is at fault. This type often involves calculating what the car was worth right before the accident. Documenting damage, including photos and repair bills, helps in estimating this type of value loss.

However, making a claim might need some legal advice or assistance from an accident lawyer. These professionals can guide you through the claims process, ensuring all costs, including immediate loss, are covered fairly by the insurance party at fault.

Calculating Diminished Value

When your car gets into an accident, its value often drops, even after repairs. This decrease in worth due to the accident is called diminished value. Understanding and calculating diminished value can help you seek fair compensation from your insurance company. Here, we’ll guide you through the steps involved in figuring out how much your vehicle has depreciated because of the accident, using easy methods like determining your car’s pre-accident value, applying the 10% cap rule, and using damage and mileage multipliers. Let’s dive in and make these concepts simple to understand!

Determining Your Car's Pre-Accident Value

To begin calculating diminished value, it’s vital to determine what your car was worth before the accident occurred. This amount is known as the pre-accident value. You can check tools such as Kelley Blue Book or consult with professional appraisers to find this value. Your car’s make, model, age, mileage, and condition all contribute to this number. Think of this as your car’s worth in a pristine, undamaged state. Knowing this helps you understand the loss you’ve faced due to the incident, setting a baseline for any diminished value claim you’ll make.

Applying the 10% Cap Rule

Once you know your car’s pre-accident value, apply the 10% cap rule to find potential limits on recovery. This rule suggests that the maximum diminished value is typically 10% of the car’s pre-accident value. For example, if your vehicle was valued at $20,000 before the accident, your diminished value claim should not exceed $2,000. This calculation provides a ceiling, guiding you on the realistic compensation you could receive. Insurance policies often use the 10% cap rule to limit payouts, making it an essential part of understanding what fair compensation looks like.

Using Damage and Mileage Multipliers

Damage and mileage multipliers are crucial in further refining your diminished value claim. These factors adjust the estimated value loss based on the severity of the accident and how much your car has been driven.

- Damage Multiplier: This reflects how extensive the damages were. Major damage results in a higher multiplier, driving down the car’s value further. Minor or moderate damage, on the other hand, may have less impact.

- Mileage Multiplier: The more miles your car has, the less value it retains, so this multiplier reduces the claim amount accordingly. High mileage diminishes a car’s resale and perceived value significantly.

These multipliers give your claim a tailored touch, ensuring it reflects all aspects of your car’s situation. Applying this to your pre-accident value gives an accurate diminished value estimation, helping you understand the compensation you rightfully deserve after an auto accident.

Understanding these components ensures you can secure the compensation to which you’re entitled. At My Auto Claim, we are committed to making this process as smooth as possible, helping you navigate every step of the diminished value claims process.

Filing a Diminished Value Claim

Filing a diminished value claim can help you recover the loss in your car’s worth after an accident. This type of claim looks to get you fair compensation for the difference between your car’s pre-accident and post-repair value. Even once the car is perfectly repaired, its accident history remains, which might make it less appealing to buyers, and thus, reduce its market value. Understanding this process ensures you don’t face further financial loss, on top of the cost of repair.

Before submitting a claim, it’s crucial to know the type of damage—whether it’s minor, moderate, or major. This helps determine the amount you might expect. Also, knowing whether the accident involved a fault driver or falls under comprehensive coverage is key. Each case is different, and the claims process may vary based on insurance policies and whether the fault party is uninsured. As we guide you through each step, rest assured knowing My Auto Claim has the expertise to help you secure fair compensation.

Collecting Necessary Documentation

Before filing your diminished value claim, gather all essential documentation. These documents form the backbone of your claim, validating the accident history and structural damages. Start with the accident report, documenting what happened and identifying the fault driver. Be sure to also gather repair estimates and receipts for any cost of repair. These papers showcase the monetary impact the accident had on your vehicle.

Next, ensure you have detailed before-and-after photos of your car. Images highlighting minor damage, moderate damage, or major damage help professional appraisers and insurance company assessors understand the extent of loss. Additionally, if you’ve received any expert assessments on the diminished value, keep those handy. These reports provide an expert view of how the accident reduced your vehicle’s market value. With everything in place, you’re prepared to move forward in the claims process.

Engaging with Insurance Companies

The step of contacting your insurance company is vital for a diminished value claim. Starting this dialogue might seem intimidating, but it’s crucial for securing the compensation you deserve. Be clear about the diminished value claim you are pursuing, whether it’s a Third-Party Diminished Value Claim or otherwise. Providing all necessary documents early can speed up the process and show that you’re factual and prepared about your situation.

Additionally, understand your insurance coverage and policies before going into negotiations. This aids in meeting all necessary legal and procedural steps, particularly if the fault party is uninsured. In some cases, you might need legal advice or the expertise of an accident lawyer, especially if you face challenges in the claims process. My Auto Claim offers tools and expertise to help you understand every aspect and ensure smooth engagement with the insurance companies.

Handling Insurance Company Resistance

Insurance companies may resist paying out diminished value claims. This resistance can come in the form of lowball offers or outright refusal, citing comprehensive coverage limits. However, you can tackle these challenges effectively. Begin by clearly presenting your collected documentation, highlighting structural damages and any professional appraisals you’ve obtained. This helps cut through resistance, showing you have a solid foundation for your claim.

Sometimes, insurance companies might question the use of damage multipliers or mileage multipliers in determining diminished value. Stand firm and provide evidence like market value analyses or other detailed appraisals to bolster your point. If the process stalls or hits a dead end, consider seeking legal advice or engaging an accident lawyer. These professionals can aid in getting you what you’re rightfully owed, ensuring that the claims process addresses your vehicle’s true diminished value. At My Auto Claim, we’re here to guide you through every step, ensuring you’re never alone in facing insurance company resistance.

Practical Tips for Claim Success

Filing a diminished value claim can seem daunting, but with the right approach, you can ensure a smooth process. Here are some expert tips to help you secure fair compensation:

- Document Everything: Keep detailed records of the accident, including photos of the damage, repair estimates, and any communication with the insurance company.

- Understand Your Insurance Policies: Familiarize yourself with your insurance coverage, including comprehensive coverage and Uninsured Motorist Coverage. Knowing your policies will help you navigate the claims process.

- Hire Professional Appraisers: A professional appraiser can assess repair-related diminished value accurately and provide a solid estimate.

- Be Aware of Damage Types: Whether it’s minor damage, moderate damage, or major damage, knowing the extent can influence your claim.

- Consider Fault and Legal Advice: If you are not the fault driver, a Third-Party Diminished Value Claim might be applicable. Consult with an accident lawyer for personalized guidance.

- Prepare for Common Types of Claims: Whether you’re dealing with property damage claims or insurance claims, readiness can lead to a successful outcome.

By following these steps, you increase the likelihood of a successful and fair resolution to your diminished value claim. Trust My Auto Claim to guide you through every step.

DIY Package

$79.99

- Instant Diminished Value Assessment

- Full Breakdown Report

- Phone and Email Support

Hybrid Package

$399.99

- Includes Perks from Basic Package

- Includes Claim Instructions

- Sample Claim Demand Letter

- Negotiation Techniques

Custom Package

Manage My Claim

- Full Service Claim Management Services

- Performed by our Trained Claim Specialists

- We Don’t Get Paid Unless You Do